MT4 Trade Manager Guide

A complete A-Z guide on how to use this amazing tool

This page will guide you through everything you need to know of the Ultimate MT4 Trade Manager including installation, potential error codes, usability and more.

Video: Installation Video

How to install the V11 for the Trade Manager

Video: "Bug" Squishing

Some perceived “bugs” that can easily be solved.

Installing the MT4 Trade Manager

Let me show you the way!

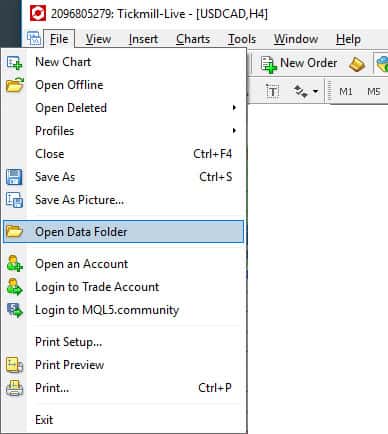

The Ultimate Trade Manager.ex4 should be placed in your “expert advisor” folder. To do this, open MT4 > File > Open Data Folder

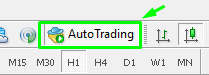

The next thing you have to do is to enable your MT4 to allow expert advisors. On the top of your MT4, there is a button called “AutoTrading”. Ensure that it is green and not red by clicking on it.

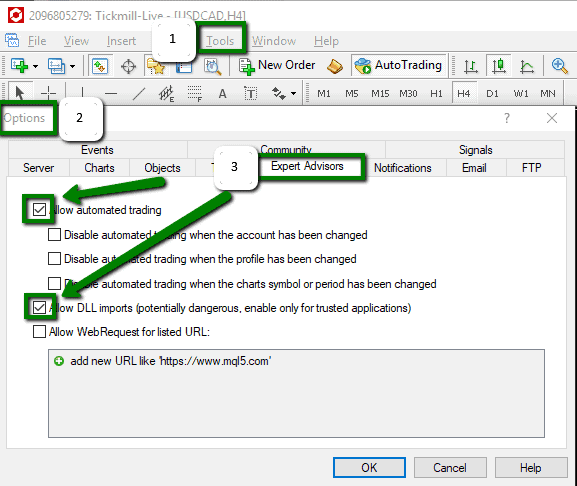

After that, you would need to go to tools > options > Expert Advisors and ensure that the 2 boxes shown in the picture are “checked”

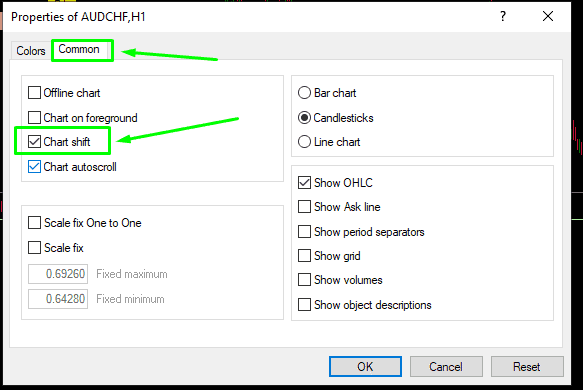

Once you’re done with all that, you have to enable “chart shift” so that the Ultimate Trade Manager has space to operate.

To do that, press F8 > Common > ensure “chart shift” is checked as seen in the picture below.

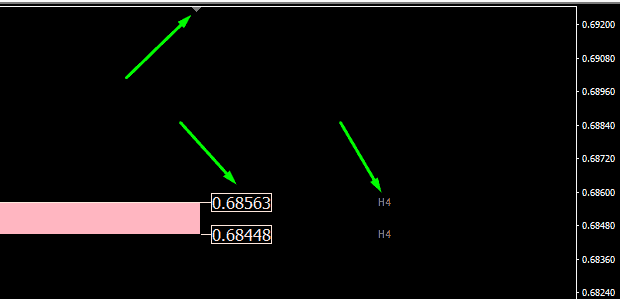

Once you enable “chart shift”, this nudges your chart to the left giving you some space on the right for the trade manager to be at.

You can adjust how much space you want on the right by sliding the little arrow left/right as seen in the picture below.

Once you’re done with this step, you have successfully installed your Ultimate Trade Manager!

First, clicking “Buy” or “Sell” would open up 7 bars for you to use. To use the bars, all you have to do is click on the specific bar and drag the line up/down to your desired level. Now, we will go through what each bar stands for :

Understanding The Different Coloured Bars

What does each bar do?

Blue Bar = Open Price

- The blue bar is adjusted to where you want your order to be triggered.

- If you don’t click and move the blue bar, it will open a market order the moment you click “place trade”.

- If you click and move it, then it will execute a pending order the moment you click “place trade”.

Red Bar = Stop Loss

- The red bar helps you adjust your stop loss.

The lot size is auto calculated no matter where you move your red bar to. - It’s important to always repeat the “define trade > risk” settings every time you adjust your stop loss. This will ensure you always have the correct lot size.

Green Bar = Final Take Profit

- The green bar helps you adjust where you want to close your position fully.

- You will need to place your take profit target before placing your partial profit targets (which is between the entry and final take profit).

Yellow Bar = Breakeven

- The yellow bar is your breakeven point.

- What happens when price reaches this level is your stop loss would be moved to your entry.

- This essentially means if price goes back up to your entry and stops you out, you will exit at breakeven (no win no loss).

- Your breakeven level can only exist between your entry to your take profit.

- You can set an automatic offset of X pips to cover your commission.

Purple Bar = Idea Invalidation

- Now, the concept of idea invalidation is not common in the market place yet. But it’s a crucially important tool when it comes to trading.

- Think of it as the “opposite of breakeven”.

- When price reaches this idea invalidation level, your take profit would be moved to your entry.

- The logic behind this is simple : When your original idea is not working, it is best to get out as soon as possible.

White Bar = Cancel Pending Order

- The white bar is there to cancel a pending order when price passes this level.

- The reason for this is sometimes we are looking to sell on a Fibonacci retracement or extension. But when price moves further away, this throws all our calculations off.

- This is an advanced feature. It can be disabled if you prefer to.

Light Green Bar = Partial Profit

- You know sometimes you want to close off part of your position but not the whole position?

- That is where our partial profit bar comes.

- You can adjust the % of your position you want to close (by default it is 50%) as seen in the picture above.

- Always place your Final Take Profit before placing your partial take profit levels.

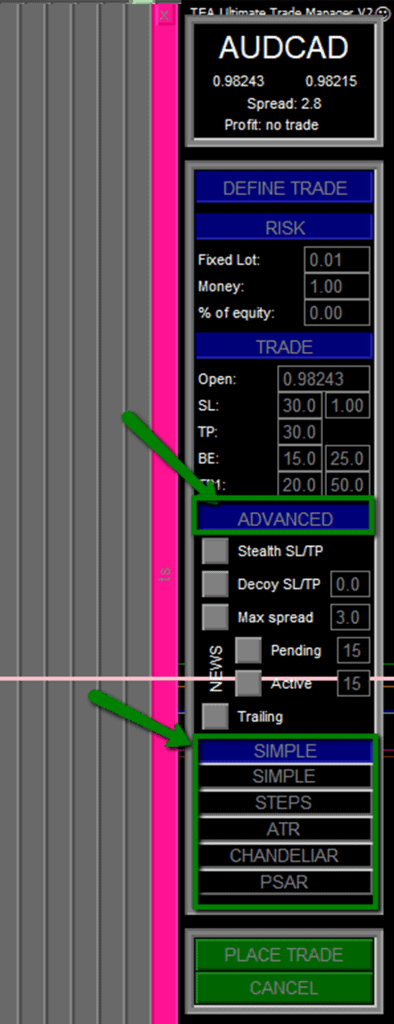

Pink Bar = Trailing Stop

- The pink bar selects the level at which your trailing stop loss would be activated.

- Currently we have a few popular trailing stop loss methods such as : Simple, Steps, ATR, Chandelier and Parabolic Sar.

- You’ll be able to adjust the settings of each trailing stop loss method once you select them under “advanced”.

Basic Settings

What do they mean?

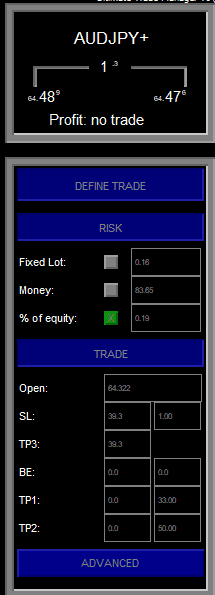

- Risk > Fixed Lot allows you to choose a default lot size each time a trade is placed

- Risk > Money lets the trade manager auto reverse calculate your lot size so that it risks the exact amount of money per trade based on your stop loss distance.

- Risk > % of equity is the most recommended setting. It lets the trade manager EA reverse calculate the exact lot size so you’re risking the exact (or as close to) the % of equity on a certain trade.

- Trade > Open simply shows the open price based on the position of the blue bar you used.

- Trade > SL means your stop loss and it shows your stop loss price.

- Trade > TP3 is your dark green bar and also your final take profit where your entire positions (or what is remaining of it) will be closed.

- Trade > BE is your breakeven price. This is where your stop loss is moved to your entry. The box on the right refers to the pips offset. A value of 1.0 means you will move your stop loss to entry +1.0 pips (good to cover commissions.

- Trade > TP1 (box on the right) allows you to state how many % of your position you wish to partially close when that level is hit.

- Trade > TP2 (box on the right) allows you to state how many % of your setup you wish to partially close. This is your second partial profit level.

- Example: Original trade is 1.0 lot. TP1 of 50% means you close 0.5 lots. TP2 of 50% means you close 50% of the remaining 0.50 lots (hence, 0.25 lots). What you’re left with is 0.25 lots for the final take profit target.

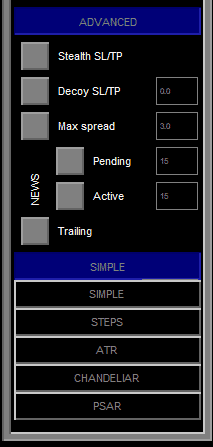

Advanced Settings

Yes it gets more advanced!

- Stealth SL/TP means to hide your stop loss and take profit from the broker. When you enable this feature, your trades won’t have any stop loss/take profit. It’s important to ensure your MT4 is always running when you use this feature because if you turn it off, the Ultimate Trade Manager would not work and you would be having a trade with no stop loss/take profit.

- Decoy SL/TP means you are able to add X pips to your stop loss/take profit to decoy the broker. Example : your buy order stop loss is at 1.0010. If you add 5 pips decoy to it, your stop loss would be at 1.0005 as seen by the broker, but it is actually at 1.0010 (the Ultimate Trade Manager will recognize this).

- Max Spread feature protects you from being filled on a trade when the spread is too big. For example, you have a pending order on EURUSD. But when price reaches your entry through a volatile news event, the spread is 20 pips. If your Max Spread setting is at 3 pips, the Ultimate Trade Manager protects you by preventing you from entering into a trade until the spread drops to 3 pips.

- News (Pending) feature removes your pending order X minutes before a news event and places it back X minutes after a news event. This is useful especially when you don’t want your trades to be affected by high volatile news events.

- News (Active) feature removes your opened active orders X minutes before a news event so that you don’t get affected by the high volatility news events.

- In both the news features mentioned above, you can adjust whether you want to be affected by high/medium/low impact news and also whether you want the news events to be displayed on the chart (via a vertical dotted line)

- Trailing allows you to select which trailing stop loss method you would like to use.

So occasionally we get error codes – but that doesn’t mean there’s something wrong with the MT4 Trade Manager. Most often, it is simply a case of understanding the broker restrictions and what they mean.

Error Codes

What do they mean and how do we solve them?

Error: Wrong Token Received

This error code occurs after you purchase a lifetime/full license of the MT4 Trade Manager and are trying to get it to work. You’re getting this error because our authentication system uses google time and your computer has a manual time set.

To solve this, simply do this:

Right-click on your date/time at the bottom right of your screen and click “Adjust date/time”. Once you’re done with that, you can check the box “Set Time Automatically” and you’re done! You can reload the MT4 Trade Manager and everything should load perfectly.

Error 134

This error occurs because there is not enough money in your account to place the trade. Usually, a case when the lot size you wish to trade is too big for the margin you have in your account.

To solve this, reduce your lot size or add more funds to your account 🙂

Error 4112

This error occurs because your broker does not allow EAs on your account. Either that, or you have disabled live trading on your MT4. First, try to solve it by doing going to your EA settings and checking these boxes (see picture).

If the problem still persists after this, there’s a high chance the broker does not allow EAs to work on this and you ought to change broker (as seriously, which broker does that these days?)

Error 4051

This error occurs because there’s an “Order Send” error, meaning MT4 does not allow the order to be sent through. The reason for this is most likely because there’s an invalid lot size.

This usually happens because you might not be following the exact sequence of steps to place a trade properly.

Try these few ways to solve the problem:

- After you have selected your entry, stop loss, take profit levels – click “Define trade” and select a risk option (eg. % equity) and type in your value there. Once done, press “Enter”.

- Does your broker have a minimum lot size for this particular instrument or account you use? Ensure the lot size is above that amount.

Error 4109

This error occurs because “Trade Is Not Allowed”. This is basically MT4 telling the Expert Advisor that it is not allowed to trade. There are 2 things you need to do to solve this.

Go to tools > Options and select the “Expert Advisors” tab.

1. Ensure “Allow automated trading” is checked.

2. When you drag the MT4 Trade Manager onto your chart, go to “Common” and ensure “Allow live trading” is checked.